BUY – Appen Limited (ASX:APX)

Appen Limited (APX) is a $4 billion global leader in voice recognition and artificial intelligence software, used by the world’s biggest technology companies like Google, Facebook, Amazon, IBM, and Microsoft who are all customers.

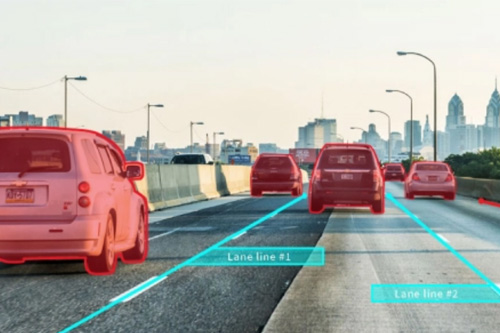

While APX’s core leadership lies in voice recognition/interpretation software, it has recently acquired businesses allowing it to leverage this strength into other areas, such as video and imaging.

Late August APX reported a mixed 1H20 result as the engine room of the business, the Core Relevance unit, delivered a strong 34% lift in sales on the back of contracts with existing customers, while the smaller Speech and Imaging unit, acquired via Figure 8 last year, was softer than expected.

Pleasingly, they reaffirmed full-year earnings guidance which is very positive in light of the COVID disruption for business activity, and the company’s commitment to maintain sales and marketing provides confidence in the business over the long term.

Arguably there was some disappointment in the result given the stock had traded up 25% in the month of August (up 80% since their February result) to an all-time high of $43.50, but now, having pulled back by 25% from those highs, and in a broadly positive market for Tech shares, we are encouraged to add an initial position.

Overall the long term drivers of the business remain in place and we see weakness post the update as an opportunity to pick up a high-quality stock with strong industry tailwinds given their competitive position. APX’s long-term growth opportunity is supported by increasing Artificial Intelligence data requirements from its major customers, and the company is consistently and highly profitable with $126 million in cash to deploy into a host of growth opportunities.

General Disclaimer

This document has been prepared for the general information of investors and not having regard to any particular person’s financial situation, objectives or needs. Accordingly, in so far as any information may constitute advice (whether express or implied), it is general advice and no recipient should rely upon it without having obtained specific advice from their advisor at Baker Young Limited. Baker Young Limited makes no representation, gives no warranty and does not accept any responsibility for the accuracy or completeness of any recommendation, information or advice contained herein. To the extent permitted by law, Baker Young Limited will not be liable to the recipient or any other persons in contract, in tort or otherwise for any loss or damage (including indirect or consequential loss) as a result of the recipient, or any other person acting or refraining from acting in reliance on any recommendation, information or advice herein. Baker Young Limited or persons associated with it, may have an interest in the securities or financial products mentioned in this document and may earn brokerage and other fees as a result of transactions in any such securities. Australian Financial Services Number 246735.