Diversify into a yield focused investment

FRP Capital believes the appropriate commercial property investment trumps all investment types due to its high-yielding nature, secure cash flow, and ability to generate long-term wealth.

The company has been helping investors grow their wealth via property since 2003. Their funds focus on various sub-sectors within the commercial real estate market, ensuring accessibility, diversity, and secure cash flow for investors around the country.

FRP Capital is an Australian-owned company with offices in Adelaide, Sydney, and Perth, with assets all around Australia. They hold an Australian Financial Services License (AFSL) for retail and wholesale funds, enabling them to create unlisted property funds and establish a solid track record in acquiring high-quality, low-risk assets with secure returns and capital growth.

Their extensive experience in sourcing and managing quality commercial property assets enables superior returns for their investors. Whether passive and secure, or high yielding, they have a tailored fund to suit a range of strategies and specific investment needs. Their goal is to enable financial freedom through exposure to quality commercial real estate.

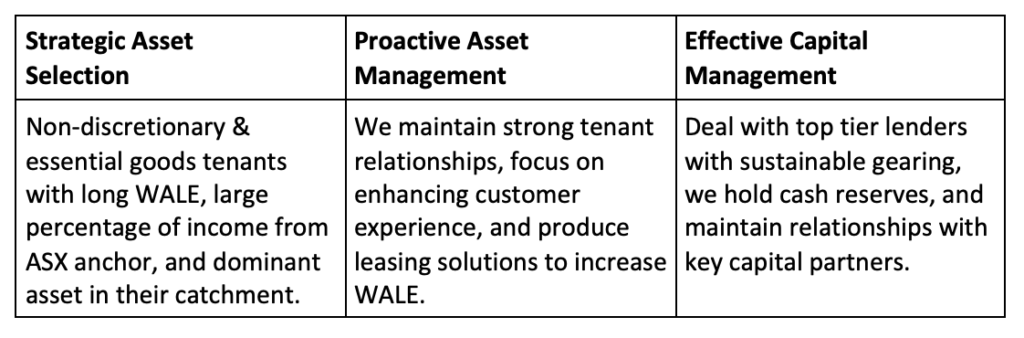

To deliver such results, FRP Capital has a three-step approach. Firstly, adhering to their strategic asset selection process and completing a strict due diligence checklist leaving no stone unturned. The due diligence involves all aspects of the property, including financial, technical, legal, planning, and economic/catchment considerations.

Secondly, FRP Capital has a highly experienced internal management team that ensures consistent and sustainable returns for investors. This team sets out a specific and strategic plan for each asset within the fund, and uses their knowledge and expertise to deliver on the strategy.

Thirdly, FRP uses strategic capital partners and top-tier lenders under a sustainable gearing ratio for acquisitions to mitigate financial risks maximise the opportunity for consistent returns. In addition, capital reserves are set aside within each fund to provide cash flow security for unexpected asset management items.

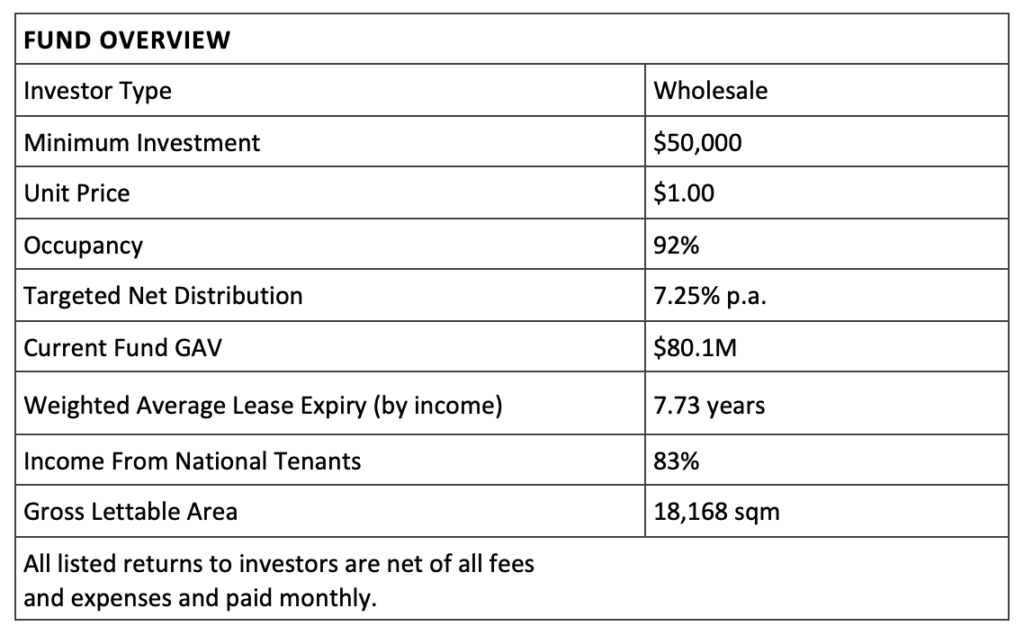

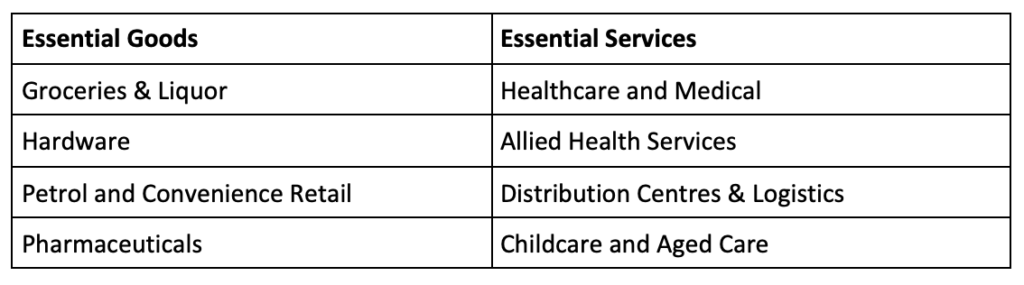

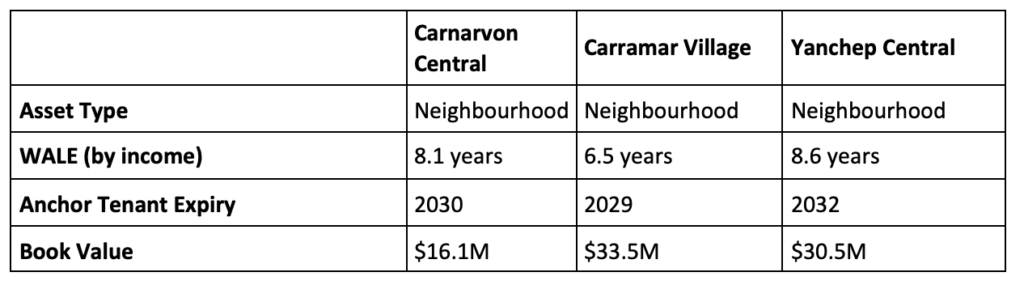

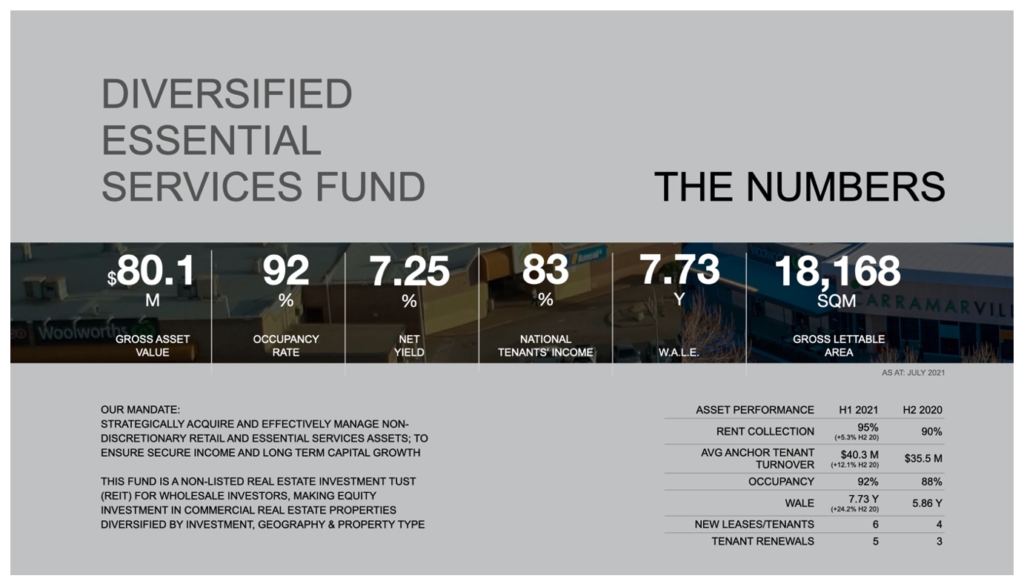

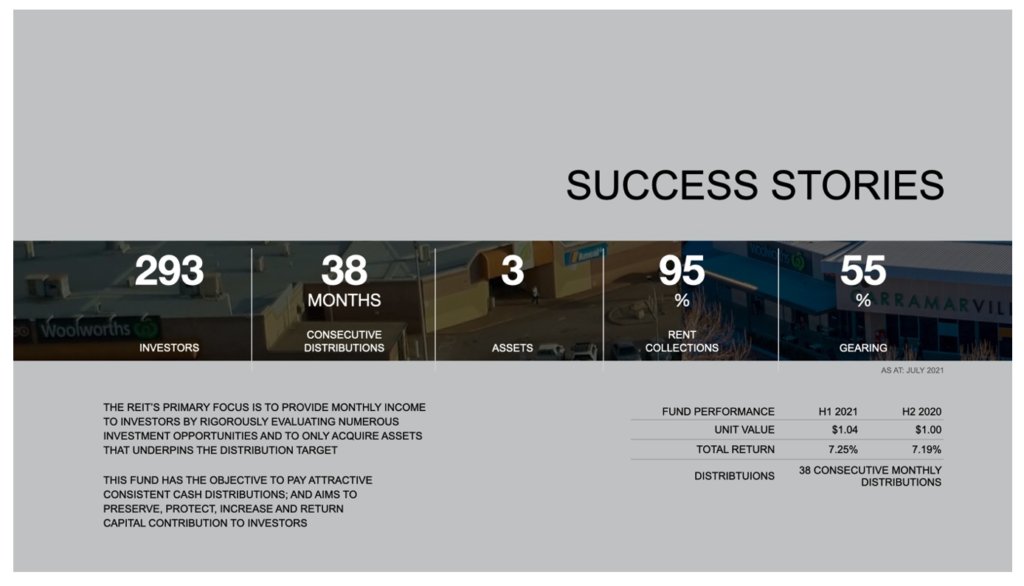

The Diversified Essential Services Fund is FRP Capital’s latest offering. The fund is a non-listed real estate investment trust (REIT), making an equity investment in commercial real estate properties diversified by investment, geography, and asset class. The mandate is clear; strategically acquire and effectively manage non-discretionary retail and essential services assets to secure income and long-term capital growth.

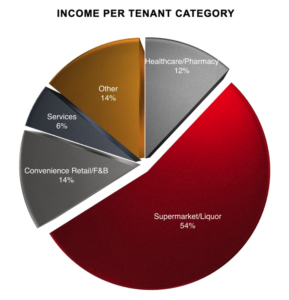

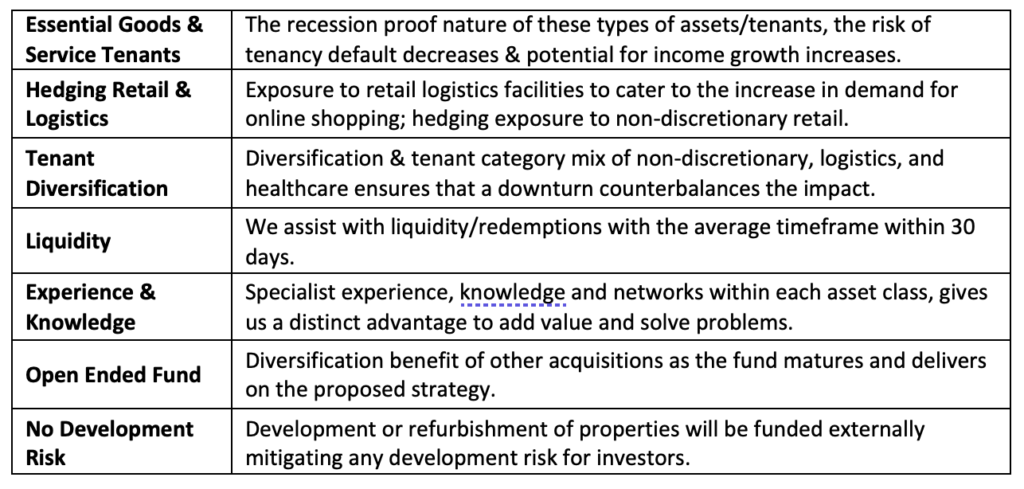

The strategy targets defensive assets with essential service and goods tenants with income diversification through asset class, tenant category, geography, and expiry profiles. The fund offers a defensive, recession-proof investment due to the nature of the target tenant mix.

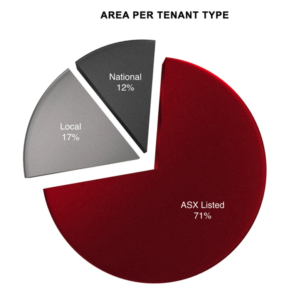

The fund provides security of income through the strength of tenants with a heavy focus on solid performing ASX listed and National tenants such as Woolworths and Coles.

The investment strategy is based on strategic asset selection, proactive asset management, and effective capital management to mitigate risks and ensure stable returns with additional long-term capital growth.

Key advantages

Strength of assets

Learn more: frpcapital.com.au

Fee Disclosure

BY is mandated by the company to provide corporate advisory services including management for the purpose of raising funds for which it has received, and will continue to receive, fees for those services.

General Disclaimer

This document has been prepared for the general information of investors and not having regard to any particular person’s financial situation, objectives or needs. Accordingly, in so far as any information may constitute advice (whether express or implied), it is general advice and no recipient should rely upon it without having obtained specific advice from their advisor at Baker Young Limited. Baker Young Limited makes no representation, gives no warranty and does not accept any responsibility for the accuracy or completeness of any recommendation, information or advice contained herein. To the extent permitted by law, Baker Young Limited will not be liable to the recipient or any other persons in contract, in tort or otherwise for any loss or damage (including indirect or consequential loss) as a result of the recipient, or any other person acting or refraining from acting in reliance on any recommendation, information or advice herein. Baker Young Limited or persons associated with it, may have an interest in the securities or financial products mentioned in this document and may earn brokerage and other fees as a result of transactions in any such securities. Australian Financial Services Number 246735.