Stream Group Limited,

to be renamed Mayfield Group Holdings Limited, “Mayfield”

is raising $1.2m in capital to relist on the ASX

and support their organic, acquisition-based growth strategy.

Baker Young Corporate Advisory is Lead Manager for the IPO.

The listing is through a Reverse Take Over (RTO) of Stream Group Limited (SGO). The prospectus has been lodged with ASIC and the ASX, and the Initial Public Offer (IPO) is due to open on October 21, 2020.

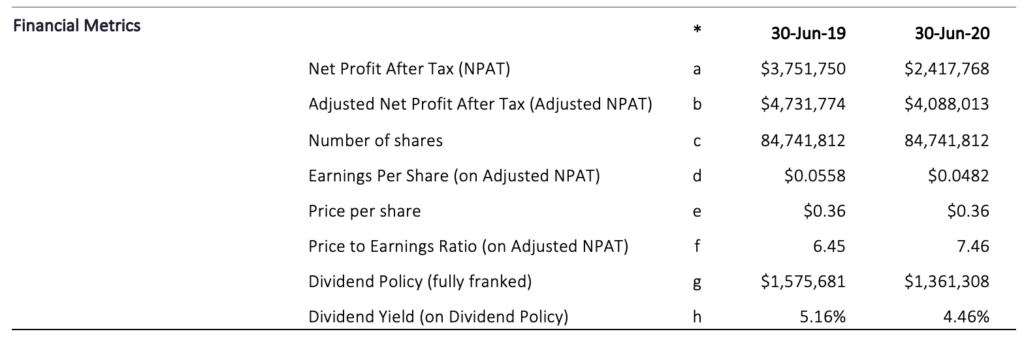

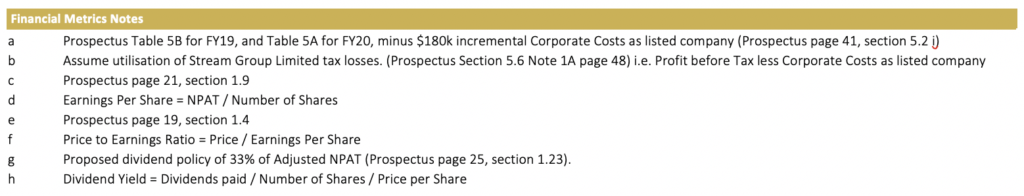

The Prospectus contains an offer to the public of 3,333,333 shares at an issue price of $0.36 per share to raise $1.2m before costs. The proceeds from the Offer together with the cash resources of both Stream and Mayfield will primarily be used to provide capital to drive the growth plans of the merged group.

This is an opportunity to gain a footprint in the company’s future growth, but shares are limited. View the IPO prospectus.

If you are interested in participating, please contact your Baker Young advisor.

Company background

Mayfield Industries Pty Ltd was established in South Australia in 1936, and the company has grown from its beginnings as a switchboard builder to become an Australian leader in electrical engineering, contracting, and distribution.

The business is a well-established, profitable group of companies supplying electrical products and services for critical infrastructure and facilities throughout Australia. It services a diverse range of industries including renewables, electricity transmission and distribution, transport, mining, and manufacturing. An increase in public and private spending on infrastructure is expected well into the foreseeable future, particularly as the move to renewable-sourced energy accelerates, and Mayfield is well placed to benefit from this trend.

The company offers ‘whole-of-life’ requirements for both public and private electrical infrastructure, providing design, manufacture, construction, and commissioning, as well as testing and maintenance services. With the high level of knowledge, intellectual property, skill, certification level, and “whole of life” offering, Mayfield believes it has a material barrier to entry for any potential new competitors. Mayfield also has a geographical spread with physical locations in Adelaide, Brisbane, Melbourne, Sydney, and Perth. Mayfield’s plan is to continue this growth strategy with the added advantage of access to capital through a wider shareholder base.

Mayfield Group Investments Pty Ltd consists of:

• Mayfield Industries Pty Ltd

• STE Solutions Pty Ltd

• Walker Control Pty Ltd

• Power Parameters Pty Ltd

• ATI Australia Pty Ltd

Fee Disclosure

Baker Young Limited (“BY”) is mandated by the Company to provide Corporate Advisory Services including Joint Lead Management for the purpose of raising funds for which it has received and will continue to receive fees for that service.

General Disclaimer

This document has been prepared for the general information of investors and not having regard to any particular person’s financial situation, objectives, or needs. Accordingly, in so far as any information may constitute advice (whether express or implied), it is general advice and no recipient should rely upon it without having obtained specific advice from their advisor at Baker Young Limited. Baker Young Limited makes no representation, gives no warranty, and does not accept any responsibility for the accuracy or completeness of any recommendation, information, or advice contained herein. To the extent permitted by law, Baker Young Limited will not be liable to the recipient or any other persons in contract, in tort or otherwise for any loss or damage (including indirect or consequential loss) as a result of the recipient, or any other person acting or refraining from acting in reliance on any recommendation, information or advice herein. Baker Young Limited or persons associated with it may have an interest in the securities or financial products mentioned in this document and may earn brokerage and other fees as a result of transactions in any such securities. Australian Financial Services Number 246735.