SUDA licences a novel iNKT cell therapy platform from Imperial College London

SUDA Pharmaceuticals Ltd (ASX:SUD) today (18 June 2021) announced that it has signed a global, exclusive Licence Agreement with Imperial College London for a novel invariant Natural Killer T (iNKT) cell therapy platform.

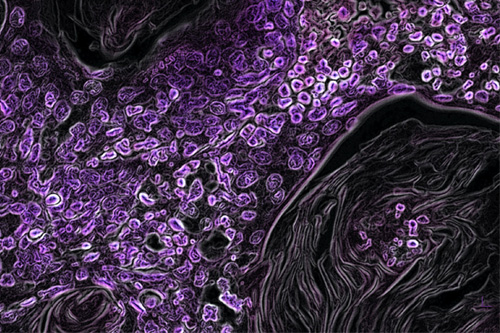

SUDA’s new iNKT cell therapy platform, currently in the preclinical stages and developed by Professor Anastasios Karadimitris at Imperial College London, has been under development for several years. The iNKT cell therapy platform can be used in conjunction with chimeric antigen receptors (CARs) to treat various blood cancers.

Cellular therapies that harness the immune system to treat cancer have ushered in an exciting era in the battle against cancer, with several products resulting in a complete cure for some patients. Still, a limitation for currently approved products is that the cell therapy must be manufactured from a patient’s own cells, making the process cumbersome and costly.

Highlights

- SUDA obtains a global, exclusive Licence from Imperial College London for a novel invariant Natural Killer T (iNKT) cell therapy platform for cancer treatment.

- The iNKT cell platform can be used in conjunction with multiple chimeric antigen receptors (CARs) to target blood cancers.

- iNKT cells are expected to be suitable for off-the-shelf dosing, as one healthy donor can supply cells to treat many patients.

- CAR-iNKT cells have been shown to outperform conventional CAR-T cell therapies in preclinical studies.

- SUDA intends to raise a minimum of $3m through a Placement to sophisticated investors.

Read the full ASX announcement here.

Register for the SUDA investor webinar presentation to be held Monday, 21 June 2021 here.

Related stories

- SUDA Pharmaceuticals: Potent drug delivery (April 2021)…Read here.

- SUDA Pharmaceuticals rights issue (July 2020)…Read here.

*Baker Young Corporate Advisory led the oversubscribed Entitlement Offer and Placement for SUDA Pharmaceuticals (SUD) last August in addition to the successful Placement in December 2020 (for which it received fees). Baker Young is currently mandated by the company to raise a minimum of $3 million AUD via an institutional Placement for which it will receive fees of 6% including approximately 3 million Options at an exercise price of $0.076 with an expiry date of two years from the allotment.

General Disclaimer

This article has been prepared for the general information of investors and not having regard to any particular person’s financial situation, objectives, or needs. Accordingly, in so far as any information may constitute advice (whether express or implied), it is general advice and no recipient should rely upon it without having obtained specific advice from their advisor at Baker Young Limited. Baker Young Limited makes no representation, gives no warranty, and does not accept any responsibility for the accuracy or completeness of any recommendation, information, or advice contained herein. To the extent permitted by law, Baker Young Limited will not be liable to the recipient or any other persons in contract, in tort or otherwise for any loss or damage (including indirect or consequential loss) as a result of the recipient, or any other person acting or refraining from acting in reliance on any recommendation, information or advice herein. Baker Young Limited or persons associated with it may have an interest in the securities or financial products mentioned in this document and may earn brokerage and other fees as a result of transactions in any such securities. Australian Financial Services Number 246735.