Baker Young Corporate Advisory exceeds $100 million in raised capital

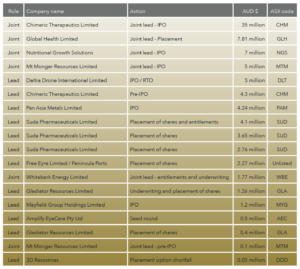

BY Corporate Advisory reached a new milestone in the 2020/21 financial year by raising more than $100m in new capital for ASX-listed and unlisted companies – $87m as Lead or Joint Lead Broker (see chart below). In total, we participated in 87 deals, including 18 Initial Public Offers (IPOs) enabling all of our clients to participate, and 69 for registered Sophisticated Investors.

We were delighted to see over 1,000 Baker Young clients participate in our corporate deals over the last financial year. Many of these deals were highly sought after and were only made available to clients of Baker Young, enabling them to take advantage of the early opportunity to acquire stock at the list price.

__________________________

Sophisticated Investors… are you on the BY Corporate Advisory Premium list?

BY Corporate Advisory now prioritises access for our Sophisticated Investors to non-disclosure (Placements, Pre-IPO and Pathfinder) deals that we lead. Clients who have registered with BY Corporate Advisory and are qualified Sophisticated Investors are given an exclusive 2-hour pre-release window to participate in our deals. After the 2-hour window, the deal is opened to other brokers and other Sophisticated Investors who do not currently have accounts with Baker Young. To register, please email corporate@bakeryoung.com.au. To find out more about becoming a Sophisticated Investor click here.

ASX Floats

BY Corporate Advisory is now releasing IPOs that are in high demand, and we look to reward our retail clients as best we can by giving them priority access. There are a few limitations for when we can disclose an IPO to retail clients, but you can be informed as soon as one of our IPOs is lodged with ASIC. BY Corporate Advisory cannot accept a bid for an IPO prior to the opening date. To receive announcements for our IPOs, please email corporate@bakeryoung.com.au to ensure you are included on our exclusive list.

BY Corporate Advisory strongly recommended you talk to your Advisor before applying for an IPO.